import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import yfinance as yf

from scipy.optimize import minimize

import seaborn as snsModern Portfolio Theory - Practical Work

L3 Finance

Part 1: Data Retrieval and Initial Processing

Question 1.1

We will work with a diversified portfolio of major stocks covering different sectors of the economy. Using the yfinance library, retrieve daily closing prices for the following stocks from January 1st, 2015 to January 1st, 2025:

Hint: Use yf.download() function with parameters: - tickers: list or string of tickers - start: start date - end: end date - interval: ‘d’ for daily data - Use the ‘Close’ column

sector_mapping = {

'Technology': ['AAPL', 'MSFT', 'INTC', 'CSCO', 'ORCL'],

'Financial': ['JPM', 'BAC', 'GS', 'MS', 'C', 'AXP', 'WFC'],

'Healthcare': ['JNJ', 'PFE', 'MRK', 'ABT', 'BMY'],

'Energy': ['XOM', 'CVX', 'COP', 'SLB', 'OXY'],

'Consumer_Staples': ['WMT', 'PG', 'KO', 'PEP', 'CL', 'KMB', 'GIS'],

'Consumer_Discretionary': ['HD', 'MCD', 'NKE', 'SBUX', 'TJX', 'LOW', 'YUM'],

'Industrial': ['CAT', 'BA', 'MMM', 'HON', 'GE', 'DE', 'FDX'],

'Materials': ['APD', 'ECL', 'NEM', 'FCX', 'PPG', 'NUE'],

'Telecommunications': ['VZ', 'T', 'CMCSA'],

'Real_Estate': ['SPG', 'PSA']

}

# Download the data

start_date = '2010-01-01'

end_date = '2025-01-01'[*********************100%***********************] 54 of 54 completedFirst few rows of the price data:

Ticker AAPL ABT APD AXP BA BAC \

Date

2010-01-04 6.447412 18.665758 52.804508 32.828983 43.777561 12.451034

2010-01-05 6.458560 18.514959 52.366360 32.756783 45.211349 12.855753

2010-01-06 6.355827 18.617779 51.934586 33.286285 46.582794 13.006530

2010-01-07 6.344077 18.772020 51.636158 33.826145 48.468563 13.435059

2010-01-08 6.386254 18.867979 51.966351 33.801979 48.001026 13.316021

Ticker BMY C CAT CL ... SBUX \

Date ...

2010-01-04 15.436789 25.928009 39.738235 28.930437 ... 8.835545

2010-01-05 15.195873 26.919380 40.213326 29.164408 ... 9.042539

2010-01-06 15.189850 27.758226 40.335484 29.098055 ... 8.977375

2010-01-07 15.201899 27.834469 40.498383 28.982828 ... 8.954374

2010-01-08 14.948930 27.376934 40.953117 28.462532 ... 8.923708

Ticker SLB SPG T TJX VZ WFC \

Date

2010-01-04 47.246723 39.174126 7.038978 7.384900 14.442019 18.417709

2010-01-05 47.380508 38.906082 7.004502 7.583662 14.468057 18.923317

2010-01-06 48.436508 38.469257 6.935692 7.614400 14.052043 18.950285

2010-01-07 48.936378 38.970608 6.857815 8.003725 13.968397 19.637922

2010-01-08 49.738956 38.037426 6.807579 7.899220 13.977206 19.455894

Ticker WMT XOM YUM

Date

2010-01-04 13.084426 39.272114 18.878279

2010-01-05 12.954136 39.425453 18.813725

2010-01-06 12.925184 39.766212 18.679226

2010-01-07 12.932426 39.641270 18.673841

2010-01-08 12.867274 39.482235 18.679226

[5 rows x 54 columns]Question 1.2

Calculate the daily returns for each asset. The daily return is defined as the percentage change in price from one day to the next.

Hint: - Use the pct_change() method from pandas - Be sure to handle any missing values that might appear

Summary statistics of daily returns:

Ticker AAPL ABT APD AXP BA \

count 3773.000000 3773.000000 3773.000000 3773.000000 3773.000000

mean 0.001124 0.000568 0.000567 0.000748 0.000625

std 0.017552 0.013505 0.015242 0.018248 0.022538

min -0.128647 -0.097857 -0.155518 -0.148187 -0.238484

25% -0.007398 -0.006053 -0.006462 -0.007042 -0.009198

50% 0.001001 0.000596 0.000751 0.000768 0.000676

75% 0.010355 0.007639 0.008000 0.009271 0.010452

max 0.119808 0.109360 0.137233 0.218822 0.243186

Ticker BAC BMY C CAT CL ... \

count 3773.000000 3773.000000 3773.000000 3773.000000 3773.000000 ...

mean 0.000559 0.000449 0.000494 0.000753 0.000365 ...

std 0.021172 0.014655 0.021367 0.018295 0.011262 ...

min -0.203182 -0.159851 -0.192986 -0.142822 -0.097829 ...

25% -0.009895 -0.006971 -0.009486 -0.008498 -0.005121 ...

50% 0.000349 0.000622 0.000294 0.000584 0.000369 ...

75% 0.010749 0.007588 0.010222 0.010267 0.006184 ...

max 0.177962 0.114425 0.179843 0.103321 0.126082 ...

Ticker SBUX SLB SPG T TJX \

count 3773.000000 3773.000000 3773.000000 3773.000000 3773.000000

mean 0.000768 0.000208 0.000605 0.000392 0.000864

std 0.017326 0.022881 0.020546 0.012944 0.015659

min -0.162042 -0.274214 -0.267127 -0.104061 -0.203995

25% -0.007363 -0.010883 -0.007593 -0.005913 -0.006955

50% 0.000654 -0.000108 0.000992 0.000725 0.000714

75% 0.008734 0.010998 0.009068 0.006838 0.008502

max 0.244970 0.199080 0.278694 0.100223 0.129033

Ticker VZ WFC WMT XOM YUM

count 3773.000000 3773.000000 3773.000000 3773.000000 3773.000000

mean 0.000333 0.000532 0.000585 0.000391 0.000631

std 0.011605 0.018845 0.012085 0.015723 0.014886

min -0.074978 -0.158676 -0.113757 -0.122248 -0.188324

25% -0.005823 -0.008342 -0.005145 -0.007267 -0.006211

50% 0.000496 0.000341 0.000679 0.000133 0.000812

75% 0.006458 0.009181 0.006373 0.007995 0.007590

max 0.092705 0.145346 0.117085 0.126868 0.232485

[8 rows x 54 columns]Question 1.3

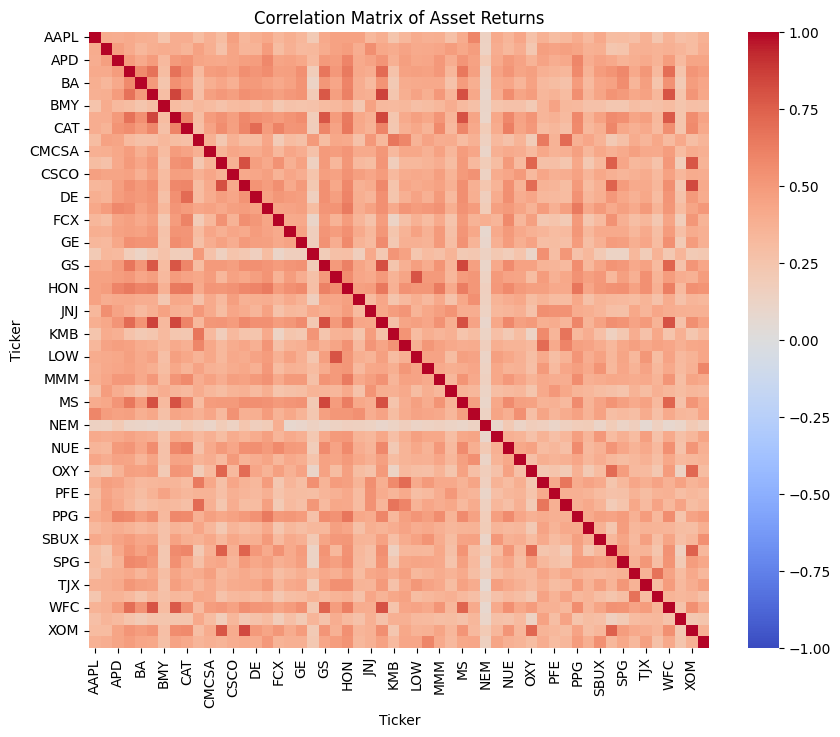

Create a visualization of the correlation between the assets using a heatmap. Also, compute and display the covariance matrix.

Hint: - Use seaborn.heatmap() for visualization - Use returns.corr() for correlation matrix - Use returns.cov() for covariance matrix

Covariance Matrix:

Ticker AAPL ABT APD AXP BA BAC BMY \

Ticker

AAPL 0.000308 0.000095 0.000105 0.000131 0.000152 0.000141 0.000065

ABT 0.000095 0.000182 0.000097 0.000101 0.000103 0.000111 0.000079

APD 0.000105 0.000097 0.000232 0.000135 0.000143 0.000158 0.000073

AXP 0.000131 0.000101 0.000135 0.000333 0.000237 0.000260 0.000081

BA 0.000152 0.000103 0.000143 0.000237 0.000508 0.000236 0.000082

BAC 0.000141 0.000111 0.000158 0.000260 0.000236 0.000448 0.000091

BMY 0.000065 0.000079 0.000073 0.000081 0.000082 0.000091 0.000215

C 0.000147 0.000114 0.000162 0.000265 0.000263 0.000383 0.000097

CAT 0.000128 0.000087 0.000147 0.000187 0.000200 0.000226 0.000074

CL 0.000059 0.000069 0.000075 0.000064 0.000070 0.000067 0.000055

CMCSA 0.000103 0.000081 0.000100 0.000136 0.000133 0.000153 0.000070

COP 0.000111 0.000078 0.000134 0.000193 0.000209 0.000226 0.000081

CSCO 0.000132 0.000096 0.000110 0.000136 0.000139 0.000163 0.000073

CVX 0.000100 0.000080 0.000121 0.000171 0.000187 0.000194 0.000077

DE 0.000120 0.000085 0.000131 0.000168 0.000198 0.000198 0.000072

ECL 0.000110 0.000097 0.000131 0.000150 0.000153 0.000159 0.000071

FCX 0.000186 0.000127 0.000210 0.000263 0.000292 0.000306 0.000103

FDX 0.000127 0.000096 0.000130 0.000163 0.000193 0.000199 0.000071

GE 0.000118 0.000087 0.000128 0.000196 0.000234 0.000221 0.000074

GIS 0.000043 0.000053 0.000058 0.000041 0.000035 0.000051 0.000046

GS 0.000131 0.000099 0.000136 0.000217 0.000207 0.000297 0.000081

HD 0.000118 0.000091 0.000107 0.000134 0.000144 0.000147 0.000070

HON 0.000116 0.000094 0.000130 0.000170 0.000195 0.000188 0.000078

INTC 0.000161 0.000108 0.000125 0.000155 0.000181 0.000171 0.000069

JNJ 0.000061 0.000078 0.000072 0.000075 0.000076 0.000084 0.000071

JPM 0.000119 0.000100 0.000139 0.000225 0.000209 0.000316 0.000083

KMB 0.000050 0.000062 0.000066 0.000056 0.000055 0.000058 0.000053

KO 0.000064 0.000065 0.000077 0.000090 0.000098 0.000088 0.000053

LOW 0.000122 0.000096 0.000113 0.000146 0.000159 0.000165 0.000072

MCD 0.000078 0.000066 0.000077 0.000098 0.000110 0.000096 0.000052

MMM 0.000099 0.000085 0.000112 0.000135 0.000138 0.000157 0.000071

MRK 0.000064 0.000084 0.000078 0.000081 0.000077 0.000096 0.000076

MS 0.000151 0.000124 0.000168 0.000256 0.000237 0.000365 0.000100

MSFT 0.000166 0.000105 0.000112 0.000136 0.000139 0.000144 0.000066

NEM 0.000056 0.000040 0.000070 0.000048 0.000056 0.000044 0.000036

NKE 0.000127 0.000093 0.000109 0.000145 0.000164 0.000148 0.000066

NUE 0.000125 0.000090 0.000155 0.000192 0.000200 0.000240 0.000079

ORCL 0.000128 0.000090 0.000115 0.000135 0.000132 0.000158 0.000066

OXY 0.000125 0.000083 0.000147 0.000224 0.000272 0.000269 0.000080

PEP 0.000071 0.000069 0.000075 0.000075 0.000079 0.000078 0.000055

PFE 0.000072 0.000084 0.000082 0.000090 0.000092 0.000106 0.000090

PG 0.000063 0.000068 0.000069 0.000066 0.000066 0.000071 0.000053

PPG 0.000113 0.000095 0.000143 0.000167 0.000177 0.000187 0.000076

PSA 0.000080 0.000070 0.000084 0.000093 0.000100 0.000104 0.000056

SBUX 0.000128 0.000091 0.000119 0.000156 0.000169 0.000161 0.000069

SLB 0.000120 0.000073 0.000145 0.000219 0.000237 0.000255 0.000077

SPG 0.000112 0.000070 0.000114 0.000218 0.000260 0.000215 0.000071

T 0.000064 0.000065 0.000076 0.000099 0.000101 0.000116 0.000055

TJX 0.000102 0.000081 0.000099 0.000147 0.000168 0.000153 0.000060

VZ 0.000049 0.000057 0.000064 0.000069 0.000066 0.000083 0.000047

WFC 0.000119 0.000097 0.000138 0.000237 0.000227 0.000315 0.000085

WMT 0.000061 0.000056 0.000058 0.000056 0.000056 0.000065 0.000043

XOM 0.000085 0.000065 0.000106 0.000149 0.000169 0.000174 0.000066

YUM 0.000098 0.000079 0.000100 0.000131 0.000144 0.000134 0.000061

Ticker C CAT CL ... SBUX SLB SPG \

Ticker ...

AAPL 0.000147 0.000128 0.000059 ... 0.000128 0.000120 0.000112

ABT 0.000114 0.000087 0.000069 ... 0.000091 0.000073 0.000070

APD 0.000162 0.000147 0.000075 ... 0.000119 0.000145 0.000114

AXP 0.000265 0.000187 0.000064 ... 0.000156 0.000219 0.000218

BA 0.000263 0.000200 0.000070 ... 0.000169 0.000237 0.000260

BAC 0.000383 0.000226 0.000067 ... 0.000161 0.000255 0.000215

BMY 0.000097 0.000074 0.000055 ... 0.000069 0.000077 0.000071

C 0.000457 0.000233 0.000072 ... 0.000169 0.000279 0.000238

CAT 0.000233 0.000335 0.000058 ... 0.000122 0.000248 0.000160

CL 0.000072 0.000058 0.000127 ... 0.000071 0.000055 0.000064

CMCSA 0.000160 0.000127 0.000066 ... 0.000113 0.000131 0.000129

COP 0.000243 0.000216 0.000055 ... 0.000123 0.000366 0.000190

CSCO 0.000166 0.000139 0.000068 ... 0.000120 0.000141 0.000115

CVX 0.000210 0.000181 0.000058 ... 0.000111 0.000286 0.000170

DE 0.000204 0.000229 0.000061 ... 0.000119 0.000205 0.000155

ECL 0.000164 0.000131 0.000072 ... 0.000127 0.000139 0.000141

FCX 0.000327 0.000345 0.000069 ... 0.000171 0.000379 0.000240

FDX 0.000213 0.000179 0.000065 ... 0.000134 0.000177 0.000157

GE 0.000237 0.000190 0.000061 ... 0.000131 0.000222 0.000192

GIS 0.000048 0.000038 0.000068 ... 0.000045 0.000036 0.000032

GS 0.000303 0.000194 0.000061 ... 0.000139 0.000217 0.000186

HD 0.000153 0.000120 0.000070 ... 0.000127 0.000111 0.000139

HON 0.000197 0.000172 0.000066 ... 0.000127 0.000175 0.000161

INTC 0.000185 0.000155 0.000062 ... 0.000123 0.000153 0.000134

JNJ 0.000086 0.000070 0.000060 ... 0.000063 0.000068 0.000060

JPM 0.000315 0.000192 0.000065 ... 0.000139 0.000221 0.000188

KMB 0.000059 0.000049 0.000086 ... 0.000057 0.000039 0.000054

KO 0.000094 0.000074 0.000071 ... 0.000075 0.000082 0.000095

LOW 0.000173 0.000135 0.000071 ... 0.000137 0.000133 0.000157

MCD 0.000107 0.000077 0.000059 ... 0.000106 0.000088 0.000104

MMM 0.000162 0.000154 0.000065 ... 0.000101 0.000142 0.000125

MRK 0.000098 0.000078 0.000059 ... 0.000068 0.000083 0.000068

MS 0.000367 0.000232 0.000074 ... 0.000167 0.000260 0.000204

MSFT 0.000152 0.000123 0.000067 ... 0.000129 0.000107 0.000105

NEM 0.000050 0.000078 0.000038 ... 0.000045 0.000099 0.000056

NKE 0.000160 0.000129 0.000065 ... 0.000153 0.000125 0.000138

NUE 0.000252 0.000230 0.000061 ... 0.000131 0.000243 0.000180

ORCL 0.000163 0.000136 0.000068 ... 0.000117 0.000129 0.000104

OXY 0.000293 0.000244 0.000058 ... 0.000142 0.000429 0.000262

PEP 0.000081 0.000062 0.000079 ... 0.000077 0.000062 0.000075

PFE 0.000109 0.000086 0.000056 ... 0.000073 0.000084 0.000079

PG 0.000073 0.000056 0.000085 ... 0.000066 0.000050 0.000056

PPG 0.000199 0.000167 0.000068 ... 0.000129 0.000165 0.000160

PSA 0.000107 0.000084 0.000068 ... 0.000090 0.000076 0.000139

SBUX 0.000169 0.000122 0.000071 ... 0.000300 0.000134 0.000157

SLB 0.000279 0.000248 0.000055 ... 0.000134 0.000524 0.000229

SPG 0.000238 0.000160 0.000064 ... 0.000157 0.000229 0.000422

T 0.000122 0.000090 0.000059 ... 0.000072 0.000102 0.000099

TJX 0.000158 0.000120 0.000062 ... 0.000125 0.000128 0.000165

VZ 0.000083 0.000067 0.000056 ... 0.000059 0.000066 0.000071

WFC 0.000311 0.000191 0.000067 ... 0.000144 0.000229 0.000205

WMT 0.000063 0.000054 0.000057 ... 0.000060 0.000044 0.000051

XOM 0.000188 0.000166 0.000052 ... 0.000093 0.000268 0.000155

YUM 0.000144 0.000114 0.000058 ... 0.000141 0.000113 0.000129

Ticker T TJX VZ WFC WMT XOM YUM

Ticker

AAPL 0.000064 0.000102 0.000049 0.000119 0.000061 0.000085 0.000098

ABT 0.000065 0.000081 0.000057 0.000097 0.000056 0.000065 0.000079

APD 0.000076 0.000099 0.000064 0.000138 0.000058 0.000106 0.000100

AXP 0.000099 0.000147 0.000069 0.000237 0.000056 0.000149 0.000131

BA 0.000101 0.000168 0.000066 0.000227 0.000056 0.000169 0.000144

BAC 0.000116 0.000153 0.000083 0.000315 0.000065 0.000174 0.000134

BMY 0.000055 0.000060 0.000047 0.000085 0.000043 0.000066 0.000061

C 0.000122 0.000158 0.000083 0.000311 0.000063 0.000188 0.000144

CAT 0.000090 0.000120 0.000067 0.000191 0.000054 0.000166 0.000114

CL 0.000059 0.000062 0.000056 0.000067 0.000057 0.000052 0.000058

CMCSA 0.000093 0.000100 0.000073 0.000139 0.000057 0.000098 0.000087

COP 0.000092 0.000115 0.000065 0.000201 0.000046 0.000263 0.000111

CSCO 0.000079 0.000102 0.000061 0.000140 0.000067 0.000103 0.000095

CVX 0.000089 0.000108 0.000067 0.000174 0.000047 0.000221 0.000102

DE 0.000085 0.000118 0.000063 0.000173 0.000055 0.000138 0.000107

ECL 0.000078 0.000115 0.000060 0.000142 0.000055 0.000102 0.000111

FCX 0.000119 0.000164 0.000083 0.000259 0.000068 0.000250 0.000165

FDX 0.000082 0.000122 0.000063 0.000173 0.000064 0.000120 0.000106

GE 0.000099 0.000133 0.000070 0.000203 0.000050 0.000153 0.000111

GIS 0.000052 0.000037 0.000050 0.000050 0.000051 0.000039 0.000040

GS 0.000097 0.000130 0.000067 0.000247 0.000056 0.000146 0.000117

HD 0.000072 0.000125 0.000060 0.000132 0.000070 0.000086 0.000104

HON 0.000085 0.000121 0.000063 0.000169 0.000055 0.000122 0.000113

INTC 0.000080 0.000112 0.000063 0.000153 0.000065 0.000111 0.000099

JNJ 0.000058 0.000058 0.000053 0.000078 0.000048 0.000062 0.000058

JPM 0.000102 0.000135 0.000074 0.000265 0.000058 0.000152 0.000119

KMB 0.000058 0.000048 0.000057 0.000055 0.000053 0.000043 0.000054

KO 0.000065 0.000070 0.000057 0.000087 0.000049 0.000071 0.000069

LOW 0.000075 0.000138 0.000060 0.000146 0.000068 0.000098 0.000112

MCD 0.000055 0.000083 0.000045 0.000092 0.000045 0.000068 0.000103

MMM 0.000076 0.000095 0.000060 0.000143 0.000052 0.000102 0.000090

MRK 0.000061 0.000062 0.000057 0.000084 0.000048 0.000070 0.000064

MS 0.000114 0.000152 0.000081 0.000293 0.000070 0.000174 0.000137

MSFT 0.000061 0.000101 0.000054 0.000124 0.000066 0.000083 0.000104

NEM 0.000047 0.000023 0.000040 0.000035 0.000029 0.000072 0.000049

NKE 0.000070 0.000130 0.000055 0.000136 0.000059 0.000094 0.000115

NUE 0.000096 0.000133 0.000077 0.000209 0.000065 0.000167 0.000115

ORCL 0.000073 0.000099 0.000057 0.000135 0.000064 0.000090 0.000089

OXY 0.000111 0.000131 0.000070 0.000243 0.000044 0.000303 0.000118

PEP 0.000061 0.000066 0.000056 0.000076 0.000060 0.000061 0.000064

PFE 0.000065 0.000065 0.000058 0.000096 0.000049 0.000072 0.000063

PG 0.000059 0.000053 0.000056 0.000068 0.000058 0.000051 0.000054

PPG 0.000078 0.000122 0.000062 0.000168 0.000049 0.000113 0.000117

PSA 0.000061 0.000080 0.000057 0.000092 0.000051 0.000064 0.000080

SBUX 0.000072 0.000125 0.000059 0.000144 0.000060 0.000093 0.000141

SLB 0.000102 0.000128 0.000066 0.000229 0.000044 0.000268 0.000113

SPG 0.000099 0.000165 0.000071 0.000205 0.000051 0.000155 0.000129

T 0.000168 0.000074 0.000101 0.000110 0.000048 0.000085 0.000063

TJX 0.000074 0.000245 0.000056 0.000143 0.000061 0.000097 0.000109

VZ 0.000101 0.000056 0.000135 0.000078 0.000046 0.000063 0.000048

WFC 0.000110 0.000143 0.000078 0.000355 0.000060 0.000162 0.000118

WMT 0.000048 0.000061 0.000046 0.000060 0.000146 0.000044 0.000045

XOM 0.000085 0.000097 0.000063 0.000162 0.000044 0.000247 0.000087

YUM 0.000063 0.000109 0.000048 0.000118 0.000045 0.000087 0.000222

[54 rows x 54 columns]Question 1.4

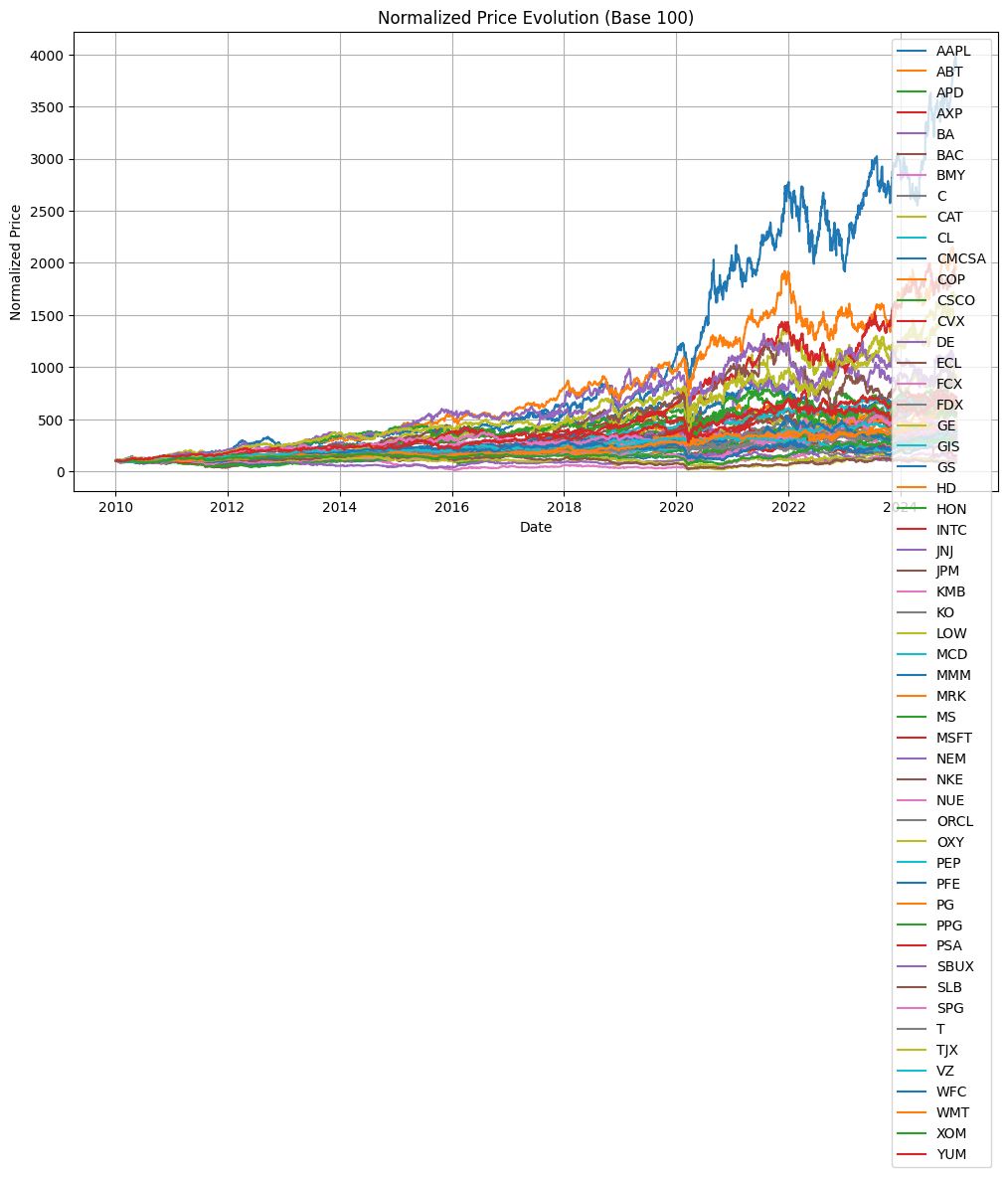

Create a plot showing the evolution of prices for all assets on the same graph. Make sure to normalize the prices to start at 100 to make them comparable.

Hint: - Normalize prices by dividing by the initial price and multiplying by 100 - Use matplotlib’s plot function - Add a legend to distinguish between assets

Part 2: Portfolio Construction and Analysis

Question 2.1

Create an equally-weighted portfolio from our five assets. Calculate its daily returns and analyze its performance metrics (mean return, volatility, Sharpe ratio assuming risk-free rate = 0).

Hint: - Equal weights means 1/N for each asset - Portfolio return is the weighted sum of individual returns - Portfolio volatility requires using the covariance matrix

Equal-weighted Portfolio Metrics (daily):

Mean Return: 0.0556%

Volatility: 1.0755%

Sharpe Ratio: 0.0517Question 2.2

Write a function that computes the mean return and volatility of a portfolio given: - A set of weights - The mean returns of individual assets - The covariance matrix of returns

Hint: - Portfolio return = weighted sum of individual returns - Portfolio variance = w^T * Σ * w (where Σ is the covariance matrix)

Test with equal weights:

Portfolio Return: 0.0556%

Portfolio Volatility: 1.0755%Question 2.3

Split your data into two periods: training (2020-2021) and testing (2022-2023). Calculate the mean returns and covariance matrix for the training period.

Hint: - Use datetime index to split the data - Recalculate all metrics on the training set

Training Period Statistics:

Mean Returns:

Ticker

AAPL 0.001087

ABT 0.000644

APD 0.000630

AXP 0.000605

BA 0.000918

BAC 0.000574

BMY 0.000599

C 0.000563

CAT 0.000624

CL 0.000349

CMCSA 0.000832

COP 0.000472

CSCO 0.000489

CVX 0.000404

DE 0.000664

ECL 0.000692

FCX 0.000109

FDX 0.000395

GE 0.000142

GIS 0.000354

GS 0.000303

HD 0.000980

HON 0.000778

INTC 0.000661

JNJ 0.000488

JPM 0.000689

KMB 0.000510

KO 0.000430

LOW 0.000846

MCD 0.000623

MMM 0.000477

MRK 0.000569

MS 0.000478

MSFT 0.000845

NEM 0.000262

NKE 0.000887

NUE 0.000329

ORCL 0.000459

OXY 0.000020

PEP 0.000477

PFE 0.000502

PG 0.000453

PPG 0.000765

PSA 0.000599

SBUX 0.000982

SLB 0.000046

SPG 0.000505

T 0.000470

TJX 0.000900

VZ 0.000514

WFC 0.000488

WMT 0.000470

XOM 0.000200

YUM 0.000729

dtype: float64

Covariance Matrix:

Ticker AAPL ABT APD AXP BA BAC BMY \

Ticker

AAPL 0.000263 0.000065 0.000078 0.000089 0.000099 0.000119 0.000058

ABT 0.000065 0.000138 0.000072 0.000077 0.000080 0.000091 0.000072

APD 0.000078 0.000072 0.000167 0.000095 0.000103 0.000129 0.000062

AXP 0.000089 0.000077 0.000095 0.000205 0.000112 0.000177 0.000066

BA 0.000099 0.000080 0.000103 0.000112 0.000244 0.000152 0.000069

BAC 0.000119 0.000091 0.000129 0.000177 0.000152 0.000419 0.000081

BMY 0.000058 0.000072 0.000062 0.000066 0.000069 0.000081 0.000211

C 0.000118 0.000099 0.000135 0.000171 0.000153 0.000332 0.000088

CAT 0.000120 0.000078 0.000127 0.000130 0.000144 0.000189 0.000068

CL 0.000042 0.000047 0.000056 0.000053 0.000058 0.000051 0.000045

CMCSA 0.000075 0.000061 0.000080 0.000092 0.000087 0.000123 0.000059

COP 0.000088 0.000068 0.000097 0.000100 0.000104 0.000153 0.000061

CSCO 0.000105 0.000075 0.000091 0.000098 0.000103 0.000142 0.000062

CVX 0.000076 0.000066 0.000089 0.000089 0.000094 0.000131 0.000059

DE 0.000101 0.000070 0.000105 0.000107 0.000123 0.000159 0.000061

ECL 0.000067 0.000065 0.000089 0.000079 0.000085 0.000111 0.000058

FCX 0.000149 0.000111 0.000167 0.000176 0.000178 0.000255 0.000091

FDX 0.000094 0.000078 0.000106 0.000114 0.000125 0.000171 0.000067

GE 0.000086 0.000069 0.000095 0.000109 0.000107 0.000161 0.000063

GIS 0.000034 0.000038 0.000044 0.000040 0.000041 0.000047 0.000034

GS 0.000100 0.000080 0.000110 0.000138 0.000122 0.000251 0.000071

HD 0.000076 0.000063 0.000076 0.000090 0.000088 0.000115 0.000059

HON 0.000093 0.000076 0.000106 0.000110 0.000124 0.000152 0.000068

INTC 0.000107 0.000077 0.000086 0.000097 0.000102 0.000129 0.000063

JNJ 0.000045 0.000057 0.000055 0.000059 0.000062 0.000069 0.000059

JPM 0.000095 0.000081 0.000111 0.000144 0.000125 0.000268 0.000075

KMB 0.000032 0.000044 0.000050 0.000042 0.000047 0.000046 0.000045

KO 0.000039 0.000043 0.000051 0.000051 0.000052 0.000057 0.000039

LOW 0.000077 0.000066 0.000082 0.000096 0.000094 0.000133 0.000061

MCD 0.000047 0.000043 0.000050 0.000050 0.000052 0.000060 0.000038

MMM 0.000082 0.000069 0.000089 0.000094 0.000101 0.000127 0.000060

MRK 0.000052 0.000074 0.000066 0.000072 0.000067 0.000090 0.000062

MS 0.000119 0.000105 0.000142 0.000178 0.000156 0.000338 0.000090

MSFT 0.000106 0.000076 0.000086 0.000097 0.000096 0.000125 0.000060

NEM 0.000043 0.000022 0.000046 0.000035 0.000035 0.000029 0.000029

NKE 0.000082 0.000066 0.000082 0.000093 0.000094 0.000114 0.000057

NUE 0.000097 0.000077 0.000119 0.000118 0.000124 0.000188 0.000070

ORCL 0.000095 0.000073 0.000094 0.000100 0.000101 0.000140 0.000064

OXY 0.000088 0.000069 0.000103 0.000097 0.000108 0.000159 0.000062

PEP 0.000038 0.000041 0.000046 0.000046 0.000048 0.000049 0.000040

PFE 0.000059 0.000069 0.000065 0.000074 0.000068 0.000096 0.000077

PG 0.000039 0.000041 0.000044 0.000047 0.000047 0.000050 0.000041

PPG 0.000085 0.000078 0.000115 0.000106 0.000110 0.000149 0.000067

PSA 0.000051 0.000045 0.000062 0.000068 0.000069 0.000089 0.000044

SBUX 0.000087 0.000063 0.000087 0.000093 0.000090 0.000116 0.000058

SLB 0.000102 0.000068 0.000111 0.000109 0.000116 0.000177 0.000061

SPG 0.000066 0.000053 0.000070 0.000084 0.000081 0.000114 0.000050

T 0.000046 0.000044 0.000051 0.000057 0.000056 0.000075 0.000041

TJX 0.000067 0.000060 0.000064 0.000075 0.000078 0.000099 0.000049

VZ 0.000037 0.000044 0.000048 0.000052 0.000049 0.000063 0.000038

WFC 0.000090 0.000077 0.000103 0.000137 0.000122 0.000234 0.000069

WMT 0.000040 0.000044 0.000041 0.000047 0.000049 0.000057 0.000039

XOM 0.000067 0.000059 0.000080 0.000078 0.000086 0.000116 0.000053

YUM 0.000075 0.000060 0.000079 0.000084 0.000086 0.000109 0.000055

Ticker C CAT CL ... SBUX SLB SPG \

Ticker ...

AAPL 0.000118 0.000120 0.000042 ... 0.000087 0.000102 0.000066

ABT 0.000099 0.000078 0.000047 ... 0.000063 0.000068 0.000053

APD 0.000135 0.000127 0.000056 ... 0.000087 0.000111 0.000070

AXP 0.000171 0.000130 0.000053 ... 0.000093 0.000109 0.000084

BA 0.000153 0.000144 0.000058 ... 0.000090 0.000116 0.000081

BAC 0.000332 0.000189 0.000051 ... 0.000116 0.000177 0.000114

BMY 0.000088 0.000068 0.000045 ... 0.000058 0.000061 0.000050

C 0.000381 0.000192 0.000059 ... 0.000117 0.000181 0.000114

CAT 0.000192 0.000293 0.000052 ... 0.000095 0.000179 0.000092

CL 0.000059 0.000052 0.000105 ... 0.000058 0.000050 0.000053

CMCSA 0.000125 0.000109 0.000052 ... 0.000080 0.000096 0.000077

COP 0.000153 0.000162 0.000047 ... 0.000072 0.000199 0.000073

CSCO 0.000141 0.000126 0.000054 ... 0.000089 0.000112 0.000076

CVX 0.000135 0.000135 0.000049 ... 0.000069 0.000158 0.000074

DE 0.000159 0.000190 0.000050 ... 0.000083 0.000140 0.000081

ECL 0.000112 0.000103 0.000052 ... 0.000077 0.000096 0.000061

FCX 0.000260 0.000310 0.000063 ... 0.000110 0.000279 0.000120

FDX 0.000173 0.000158 0.000053 ... 0.000095 0.000135 0.000088

GE 0.000165 0.000138 0.000050 ... 0.000083 0.000135 0.000082

GIS 0.000047 0.000040 0.000051 ... 0.000042 0.000042 0.000046

GS 0.000243 0.000154 0.000047 ... 0.000089 0.000142 0.000086

HD 0.000116 0.000097 0.000050 ... 0.000087 0.000082 0.000075

HON 0.000154 0.000149 0.000058 ... 0.000094 0.000126 0.000084

INTC 0.000134 0.000128 0.000046 ... 0.000077 0.000106 0.000072

JNJ 0.000074 0.000061 0.000045 ... 0.000051 0.000059 0.000047

JPM 0.000257 0.000155 0.000052 ... 0.000094 0.000148 0.000093

KMB 0.000049 0.000046 0.000069 ... 0.000047 0.000038 0.000050

KO 0.000061 0.000054 0.000052 ... 0.000049 0.000051 0.000050

LOW 0.000131 0.000111 0.000051 ... 0.000093 0.000098 0.000081

MCD 0.000064 0.000055 0.000042 ... 0.000068 0.000048 0.000046

MMM 0.000128 0.000130 0.000052 ... 0.000073 0.000113 0.000073

MRK 0.000092 0.000074 0.000046 ... 0.000060 0.000067 0.000058

MS 0.000328 0.000198 0.000063 ... 0.000120 0.000192 0.000114

MSFT 0.000129 0.000116 0.000050 ... 0.000091 0.000091 0.000066

NEM 0.000037 0.000075 0.000027 ... 0.000025 0.000086 0.000044

NKE 0.000120 0.000103 0.000051 ... 0.000099 0.000092 0.000075

NUE 0.000188 0.000179 0.000052 ... 0.000093 0.000163 0.000091

ORCL 0.000146 0.000125 0.000053 ... 0.000090 0.000117 0.000076

OXY 0.000164 0.000161 0.000049 ... 0.000082 0.000202 0.000087

PEP 0.000055 0.000046 0.000053 ... 0.000046 0.000044 0.000046

PFE 0.000099 0.000079 0.000041 ... 0.000061 0.000075 0.000061

PG 0.000056 0.000047 0.000063 ... 0.000047 0.000044 0.000046

PPG 0.000153 0.000143 0.000059 ... 0.000088 0.000121 0.000084

PSA 0.000090 0.000073 0.000050 ... 0.000068 0.000068 0.000111

SBUX 0.000117 0.000095 0.000058 ... 0.000221 0.000088 0.000079

SLB 0.000181 0.000179 0.000050 ... 0.000088 0.000309 0.000091

SPG 0.000114 0.000092 0.000053 ... 0.000079 0.000091 0.000174

T 0.000080 0.000069 0.000043 ... 0.000047 0.000066 0.000052

TJX 0.000101 0.000082 0.000046 ... 0.000079 0.000071 0.000070

VZ 0.000067 0.000056 0.000044 ... 0.000047 0.000053 0.000055

WFC 0.000221 0.000139 0.000051 ... 0.000097 0.000136 0.000094

WMT 0.000060 0.000049 0.000042 ... 0.000049 0.000041 0.000048

XOM 0.000121 0.000118 0.000047 ... 0.000061 0.000137 0.000066

YUM 0.000114 0.000098 0.000050 ... 0.000102 0.000078 0.000069

Ticker T TJX VZ WFC WMT XOM YUM

Ticker

AAPL 0.000046 0.000067 0.000037 0.000090 0.000040 0.000067 0.000075

ABT 0.000044 0.000060 0.000044 0.000077 0.000044 0.000059 0.000060

APD 0.000051 0.000064 0.000048 0.000103 0.000041 0.000080 0.000079

AXP 0.000057 0.000075 0.000052 0.000137 0.000047 0.000078 0.000084

BA 0.000056 0.000078 0.000049 0.000122 0.000049 0.000086 0.000086

BAC 0.000075 0.000099 0.000063 0.000234 0.000057 0.000116 0.000109

BMY 0.000041 0.000049 0.000038 0.000069 0.000039 0.000053 0.000055

C 0.000080 0.000101 0.000067 0.000221 0.000060 0.000121 0.000114

CAT 0.000069 0.000082 0.000056 0.000139 0.000049 0.000118 0.000098

CL 0.000043 0.000046 0.000044 0.000051 0.000042 0.000047 0.000050

CMCSA 0.000064 0.000069 0.000058 0.000104 0.000048 0.000076 0.000072

COP 0.000056 0.000063 0.000050 0.000117 0.000040 0.000139 0.000076

CSCO 0.000057 0.000074 0.000048 0.000110 0.000051 0.000082 0.000078

CVX 0.000058 0.000060 0.000054 0.000106 0.000041 0.000124 0.000066

DE 0.000061 0.000072 0.000052 0.000121 0.000043 0.000091 0.000082

ECL 0.000046 0.000063 0.000044 0.000088 0.000039 0.000071 0.000072

FCX 0.000089 0.000105 0.000075 0.000187 0.000061 0.000176 0.000119

FDX 0.000062 0.000085 0.000052 0.000132 0.000053 0.000091 0.000091

GE 0.000066 0.000074 0.000058 0.000125 0.000044 0.000092 0.000074

GIS 0.000039 0.000038 0.000040 0.000044 0.000037 0.000038 0.000039

GS 0.000064 0.000078 0.000052 0.000172 0.000047 0.000097 0.000086

HD 0.000050 0.000086 0.000046 0.000094 0.000053 0.000064 0.000075

HON 0.000059 0.000078 0.000053 0.000122 0.000050 0.000087 0.000086

INTC 0.000054 0.000072 0.000048 0.000101 0.000045 0.000082 0.000077

JNJ 0.000041 0.000042 0.000043 0.000063 0.000037 0.000053 0.000048

JPM 0.000068 0.000083 0.000060 0.000189 0.000051 0.000103 0.000092

KMB 0.000043 0.000039 0.000048 0.000045 0.000041 0.000042 0.000046

KO 0.000040 0.000038 0.000043 0.000054 0.000037 0.000046 0.000046

LOW 0.000052 0.000092 0.000047 0.000106 0.000055 0.000073 0.000079

MCD 0.000033 0.000046 0.000035 0.000053 0.000035 0.000042 0.000067

MMM 0.000053 0.000063 0.000050 0.000102 0.000045 0.000080 0.000070

MRK 0.000049 0.000050 0.000050 0.000074 0.000042 0.000061 0.000058

MS 0.000082 0.000102 0.000069 0.000227 0.000062 0.000125 0.000108

MSFT 0.000051 0.000066 0.000049 0.000099 0.000048 0.000074 0.000086

NEM 0.000031 0.000011 0.000027 0.000022 0.000015 0.000057 0.000026

NKE 0.000048 0.000089 0.000044 0.000096 0.000049 0.000065 0.000083

NUE 0.000068 0.000080 0.000060 0.000139 0.000054 0.000111 0.000087

ORCL 0.000056 0.000071 0.000048 0.000106 0.000046 0.000083 0.000079

OXY 0.000060 0.000068 0.000052 0.000123 0.000039 0.000132 0.000078

PEP 0.000037 0.000038 0.000042 0.000047 0.000038 0.000042 0.000042

PFE 0.000047 0.000051 0.000046 0.000081 0.000041 0.000063 0.000055

PG 0.000039 0.000036 0.000042 0.000047 0.000040 0.000044 0.000041

PPG 0.000057 0.000079 0.000055 0.000118 0.000046 0.000086 0.000086

PSA 0.000042 0.000056 0.000046 0.000076 0.000040 0.000050 0.000065

SBUX 0.000047 0.000079 0.000047 0.000097 0.000049 0.000061 0.000102

SLB 0.000066 0.000071 0.000053 0.000136 0.000041 0.000137 0.000078

SPG 0.000052 0.000070 0.000055 0.000094 0.000048 0.000066 0.000069

T 0.000111 0.000045 0.000073 0.000066 0.000039 0.000056 0.000044

TJX 0.000045 0.000172 0.000043 0.000082 0.000050 0.000056 0.000070

VZ 0.000073 0.000043 0.000111 0.000059 0.000040 0.000048 0.000043

WFC 0.000066 0.000082 0.000059 0.000229 0.000050 0.000097 0.000088

WMT 0.000039 0.000050 0.000040 0.000050 0.000118 0.000039 0.000041

XOM 0.000056 0.000056 0.000048 0.000097 0.000039 0.000136 0.000061

YUM 0.000044 0.000070 0.000043 0.000088 0.000041 0.000061 0.000198

[54 rows x 54 columns]Question 2.4

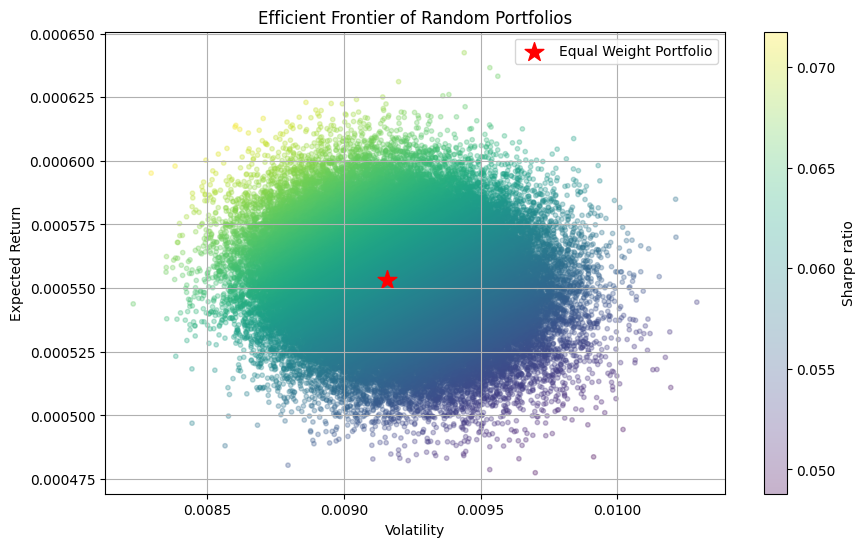

Create a function to generate random portfolio weights and use it to create the efficient frontier visualization. Generate 1000 random portfolios and plot them on a risk-return graph.

Hint: - Use np.random.random() to generate weights - Normalize weights to sum to 1 - Store results in arrays for plotting - Highlight the minimum variance and maximum Sharpe ratio portfolios

Question 2.5

Use scipy’s optimize function to find the minimum variance portfolio and the maximum Sharpe ratio portfolio. Make sure to include the constraint that weights must sum to 1 and be non-negative.

Hint: - Use scipy.optimize.minimize - Define objective functions for minimum variance and maximum Sharpe ratio - Use SLSQP optimizer - Check the optimization success flag

Minimum Variance Portfolio:

AAPL: 0.0134

MSFT: 0.0049

INTC: 0.0000

CSCO: 0.0000

ORCL: 0.0000

JPM: 0.0000

BAC: 0.0103

GS: 0.0000

MS: 0.0000

C: 0.0000

AXP: 0.0000

WFC: 0.0000

JNJ: 0.0000

PFE: 0.0000

MRK: 0.0000

ABT: 0.0000

BMY: 0.0000

XOM: 0.0000

CVX: 0.0000

COP: 0.0846

SLB: 0.0000

OXY: 0.0000

WMT: 0.0000

PG: 0.0000

KO: 0.0952

PEP: 0.0000

CL: 0.0342

KMB: 0.0841

GIS: 0.0000

HD: 0.1474

MCD: 0.0000

NKE: 0.0015

SBUX: 0.0000

TJX: 0.0000

LOW: 0.0445

YUM: 0.0000

CAT: 0.0000

BA: 0.0000

MMM: 0.0000

HON: 0.1014

GE: 0.0133

DE: 0.0877

FDX: 0.0000

APD: 0.0061

ECL: 0.0000

NEM: 0.0000

FCX: 0.0000

PPG: 0.0696

NUE: 0.0297

VZ: 0.0575

T: 0.0000

CMCSA: 0.1146

SPG: 0.0000

PSA: 0.0000

Expected Return: 0.0499%

Volatility: 0.6731%

Maximum Sharpe Ratio Portfolio:

AAPL: 0.1639

MSFT: 0.0000

INTC: 0.0000

CSCO: 0.0000

ORCL: 0.0310

JPM: 0.0000

BAC: 0.0101

GS: 0.0000

MS: 0.0000

C: 0.0000

AXP: 0.0556

WFC: 0.0000

JNJ: 0.0000

PFE: 0.0000

MRK: 0.0000

ABT: 0.0000

BMY: 0.0000

XOM: 0.0000

CVX: 0.0000

COP: 0.0000

SLB: 0.0000

OXY: 0.2121

WMT: 0.0000

PG: 0.0000

KO: 0.0000

PEP: 0.0000

CL: 0.0647

KMB: 0.0000

GIS: 0.0000

HD: 0.1537

MCD: 0.0000

NKE: 0.0000

SBUX: 0.0000

TJX: 0.0015

LOW: 0.0009

YUM: 0.0187

CAT: 0.0000

BA: 0.0000

MMM: 0.0000

HON: 0.0285

GE: 0.0000

DE: 0.0000

FDX: 0.0000

APD: 0.0000

ECL: 0.0780

NEM: 0.0000

FCX: 0.0000

PPG: 0.0000

NUE: 0.1387

VZ: 0.0425

T: 0.0000

CMCSA: 0.0000

SPG: 0.0000

PSA: 0.0000

Expected Return: 0.0850%

Volatility: 0.8703%Question 2.6

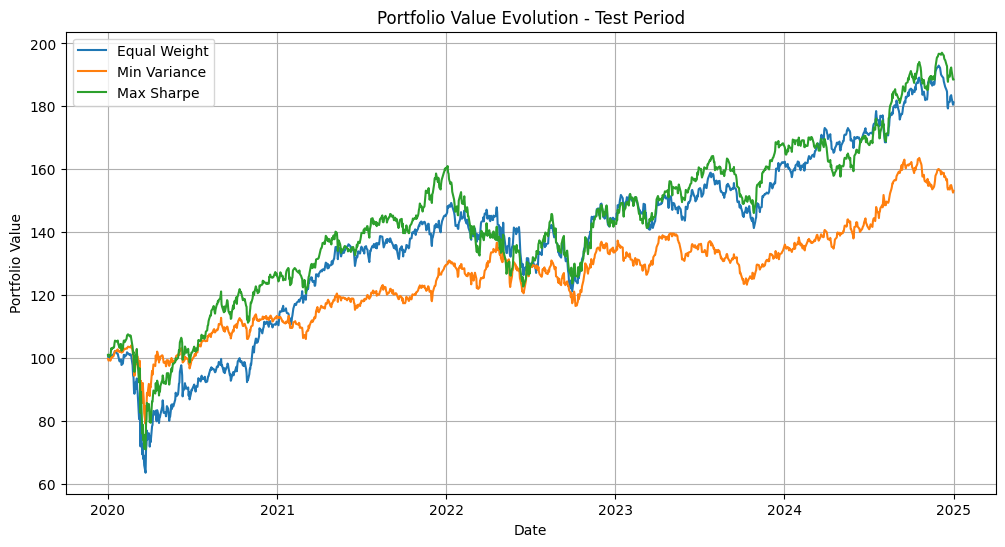

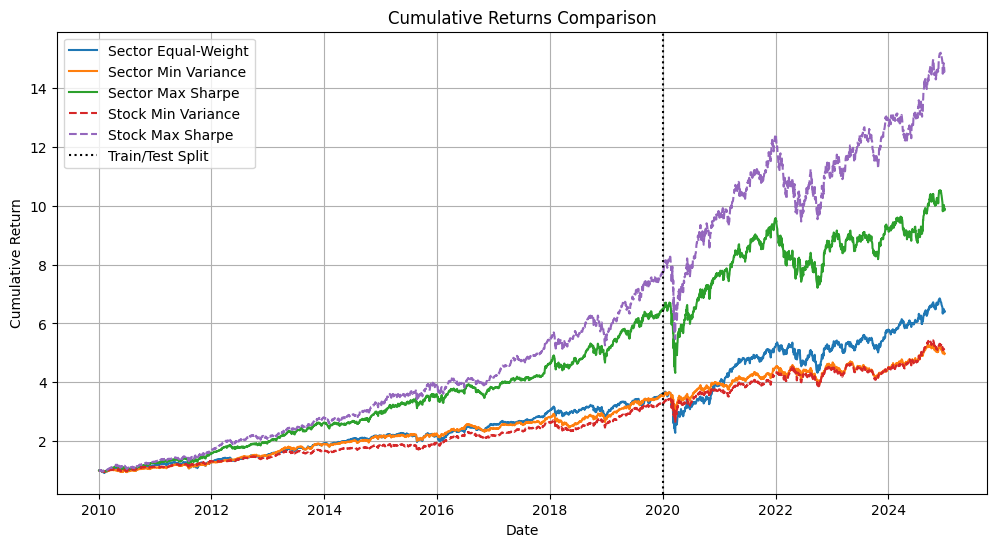

Backtest your optimized portfolios (minimum variance and maximum Sharpe ratio) on the test period. Compare their performance with the equally-weighted portfolio.

Hint: - Use the weights found in the training period - Calculate cumulative returns for each portfolio - Plot the evolution of portfolio values - Calculate key performance metrics (return, volatility, Sharpe ratio, maximum drawdown)

Train Period Performance:

Equal Weight:

Mean Return: 0.0553%

Volatility: 0.9158%

Sharpe Ratio: 6.0422%

Cumulative Return: 261.7286%

Min Variance:

Mean Return: 0.0499%

Volatility: 0.6731%

Sharpe Ratio: 7.4197%

Cumulative Return: 231.6049%

Max Sharpe:

Mean Return: 0.0850%

Volatility: 0.8703%

Sharpe Ratio: 9.7722%

Cumulative Return: 671.2589%

Test Period Performance:

Equal Weight:

Mean Return: 0.0563%

Volatility: 1.3392%

Sharpe Ratio: 4.2020%

Cumulative Return: 81.2116%

Min Variance:

Mean Return: 0.0390%

Volatility: 1.0081%

Sharpe Ratio: 3.8640%

Cumulative Return: 53.1191%

Max Sharpe:

Mean Return: 0.0595%

Volatility: 1.3445%

Sharpe Ratio: 4.4278%

Cumulative Return: 88.5475%Part 3: Sector-Based Portfolio Analysis

Question 3.1: Creating Sector Returns

Create sector-based returns by averaging returns of stocks within the same sector. First, define sector mappings, then compute their historical returns using our existing returns data.

Hint: - Define a dictionary mapping sectors to their constituent stocks - Use pandas mean() function to compute average returns - Remember to handle the train/test split consistently with previous analysis

Sector Returns Summary (Training Period):

Technology Financial Healthcare Energy Consumer_Staples \

count 2515.000000 2515.000000 2515.000000 2515.000000 2515.000000

mean 0.000708 0.000529 0.000561 0.000228 0.000435

std 0.011622 0.015460 0.009070 0.013255 0.007475

min -0.056637 -0.120743 -0.048842 -0.080151 -0.039052

25% -0.004963 -0.006888 -0.004165 -0.006827 -0.003661

50% 0.000966 0.000601 0.000699 0.000480 0.000543

75% 0.006897 0.008406 0.005836 0.007352 0.004696

max 0.063131 0.090448 0.049754 0.058274 0.035414

Consumer_Discretionary Industrial Materials Telecommunications \

count 2515.000000 2515.000000 2515.000000 2515.000000

mean 0.000850 0.000571 0.000464 0.000605

std 0.009784 0.011905 0.013003 0.009453

min -0.055153 -0.069274 -0.058961 -0.054617

25% -0.004366 -0.005423 -0.006640 -0.004637

50% 0.001120 0.000822 0.000835 0.001034

75% 0.006386 0.006830 0.007747 0.006185

max 0.058083 0.059283 0.075934 0.038374

Real_Estate

count 2515.000000

mean 0.000552

std 0.011736

min -0.079154

25% -0.005862

50% 0.000981

75% 0.007002

max 0.109263

Sector Return Correlations (Training Period):

Technology Financial Healthcare Energy \

Technology 1.000000 0.652064 0.603375 0.597924

Financial 0.652064 1.000000 0.572227 0.634610

Healthcare 0.603375 0.572227 1.000000 0.527469

Energy 0.597924 0.634610 0.527469 1.000000

Consumer_Staples 0.515071 0.434815 0.616829 0.436855

Consumer_Discretionary 0.673522 0.631643 0.607782 0.538476

Industrial 0.739289 0.762015 0.628253 0.719753

Materials 0.619829 0.639049 0.543687 0.716903

Telecommunications 0.553905 0.557995 0.584180 0.523741

Real_Estate 0.473704 0.491617 0.476236 0.440345

Consumer_Staples Consumer_Discretionary Industrial \

Technology 0.515071 0.673522 0.739289

Financial 0.434815 0.631643 0.762015

Healthcare 0.616829 0.607782 0.628253

Energy 0.436855 0.538476 0.719753

Consumer_Staples 1.000000 0.603731 0.535556

Consumer_Discretionary 0.603731 1.000000 0.704662

Industrial 0.535556 0.704662 1.000000

Materials 0.466227 0.579457 0.751812

Telecommunications 0.613324 0.583881 0.610452

Real_Estate 0.532315 0.572199 0.537836

Materials Telecommunications Real_Estate

Technology 0.619829 0.553905 0.473704

Financial 0.639049 0.557995 0.491617

Healthcare 0.543687 0.584180 0.476236

Energy 0.716903 0.523741 0.440345

Consumer_Staples 0.466227 0.613324 0.532315

Consumer_Discretionary 0.579457 0.583881 0.572199

Industrial 0.751812 0.610452 0.537836

Materials 1.000000 0.529148 0.465546

Telecommunications 0.529148 1.000000 0.499715

Real_Estate 0.465546 0.499715 1.000000 Question 3.2: Weight Conversion Function

Create and test a function that converts sector-level portfolio weights into individual stock weights, assuming equal weighting within each sector.

Hint: - Each stock within a sector should have equal weight - The sum of all stock weights should equal 1 - Test the function with simple cases

Test 1: Equal sector weights

Sector weights:

Technology: 0.1000

Financial: 0.1000

Healthcare: 0.1000

Energy: 0.1000

Consumer_Staples: 0.1000

Consumer_Discretionary: 0.1000

Industrial: 0.1000

Materials: 0.1000

Telecommunications: 0.1000

Real_Estate: 0.1000

Resulting stock weights:

AAPL: 0.0200

MSFT: 0.0200

INTC: 0.0200

CSCO: 0.0200

ORCL: 0.0200

JPM: 0.0143

BAC: 0.0143

GS: 0.0143

MS: 0.0143

C: 0.0143

AXP: 0.0143

WFC: 0.0143

JNJ: 0.0200

PFE: 0.0200

MRK: 0.0200

ABT: 0.0200

BMY: 0.0200

XOM: 0.0200

CVX: 0.0200

COP: 0.0200

SLB: 0.0200

OXY: 0.0200

WMT: 0.0143

PG: 0.0143

KO: 0.0143

PEP: 0.0143

CL: 0.0143

KMB: 0.0143

GIS: 0.0143

HD: 0.0143

MCD: 0.0143

NKE: 0.0143

SBUX: 0.0143

TJX: 0.0143

LOW: 0.0143

YUM: 0.0143

CAT: 0.0143

BA: 0.0143

MMM: 0.0143

HON: 0.0143

GE: 0.0143

DE: 0.0143

FDX: 0.0143

APD: 0.0167

ECL: 0.0167

NEM: 0.0167

FCX: 0.0167

PPG: 0.0167

NUE: 0.0167

VZ: 0.0333

T: 0.0333

CMCSA: 0.0333

SPG: 0.0500

PSA: 0.0500

Test 2: Custom sector weights

Sector weights:

Technology: 0.3000

Financial: 0.2000

Healthcare: 0.2000

Energy: 0.1000

Consumer_Staples: 0.1000

Consumer_Discretionary: 0.1000

Resulting stock weights:

AAPL: 0.0600

MSFT: 0.0600

INTC: 0.0600

CSCO: 0.0600

ORCL: 0.0600

JPM: 0.0286

BAC: 0.0286

GS: 0.0286

MS: 0.0286

C: 0.0286

AXP: 0.0286

WFC: 0.0286

JNJ: 0.0400

PFE: 0.0400

MRK: 0.0400

ABT: 0.0400

BMY: 0.0400

XOM: 0.0200

CVX: 0.0200

COP: 0.0200

SLB: 0.0200

OXY: 0.0200

WMT: 0.0143

PG: 0.0143

KO: 0.0143

PEP: 0.0143

CL: 0.0143

KMB: 0.0143

GIS: 0.0143

HD: 0.0143

MCD: 0.0143

NKE: 0.0143

SBUX: 0.0143

TJX: 0.0143

LOW: 0.0143

YUM: 0.0143

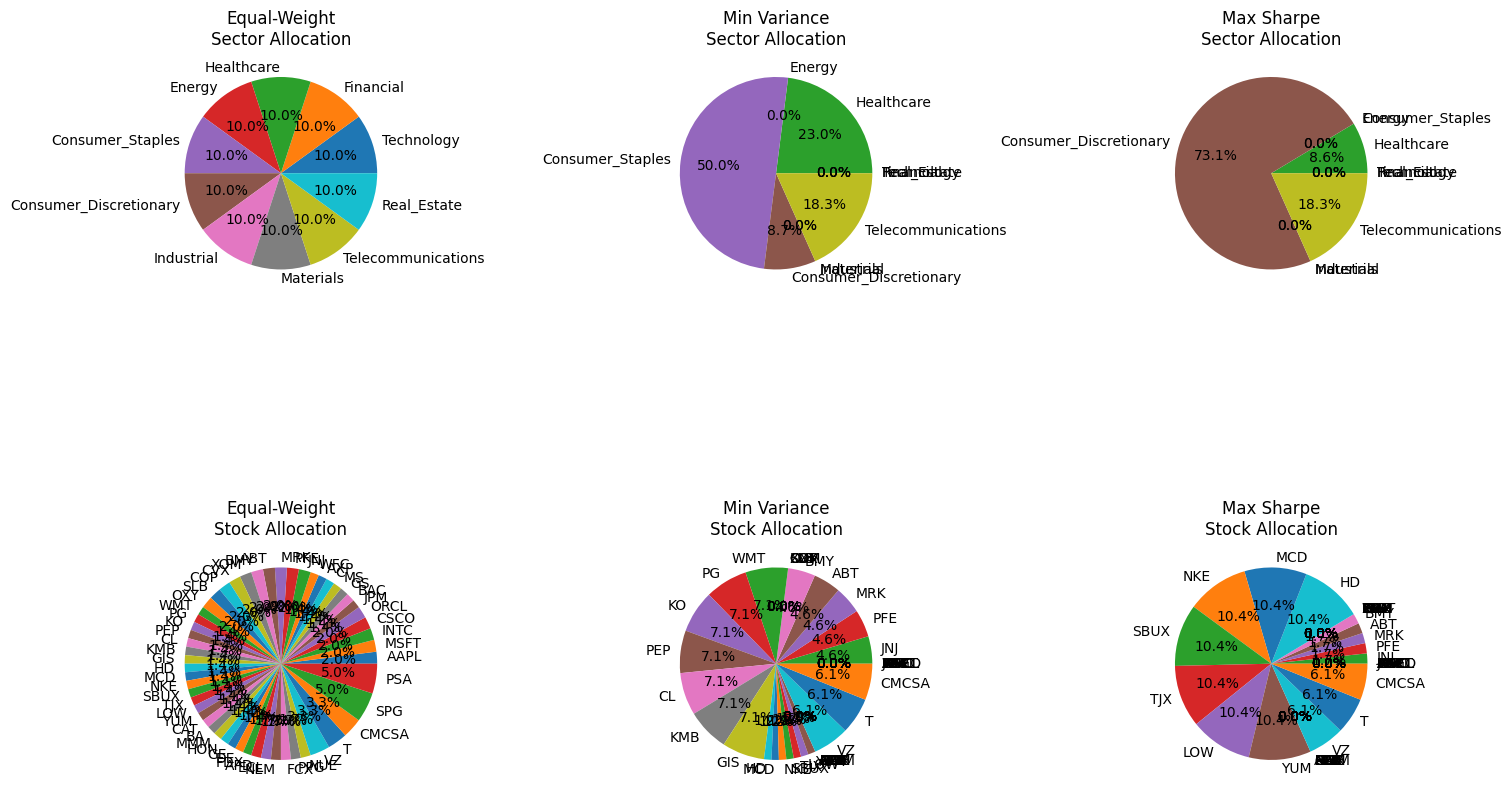

Verification - sum of weights: 1.000000Question 3.3: Sector Portfolio Optimization

Using the training period data, optimize sector-based portfolios for minimum variance and maximum Sharpe ratio. Compare with an equal-weight sector allocation.

Hint: - Use the same optimization approach as in Part 2 - Remember to create new constraints for the number of sectors - Use only training period data for optimization

Minimum Variance Portfolio Weights:

Technology: 0.0000

Financial: 0.0000

Healthcare: 0.2300

Energy: 0.0000

Consumer_Staples: 0.4999

Consumer_Discretionary: 0.0869

Industrial: 0.0000

Materials: 0.0000

Telecommunications: 0.1832

Real_Estate: 0.0000

Maximum Sharpe Ratio Portfolio Weights:

Technology: 0.0000

Financial: 0.0000

Healthcare: 0.0861

Energy: 0.0000

Consumer_Staples: 0.0000

Consumer_Discretionary: 0.7308

Industrial: 0.0000

Materials: 0.0000

Telecommunications: 0.1831

Real_Estate: 0.0000Question 3.4: Portfolio Visualization

Create visualizations to compare the sector allocations and corresponding stock allocations for each portfolio strategy.

Hint: - Use pie charts to show both sector and stock level allocations - Use the sector_to_stock_weights function from Question 3.2 - Consider using subplots for clear comparison

Part 4: Risk Analysis

Question 4.1: Risk Metrics Function

Create a function to calculate various risk metrics for a return series: - Maximum Drawdown - Sortino Ratio - Value at Risk (VaR) - Conditional Value at Risk (CVaR)

Hint: - Use cumulative returns for drawdown calculation - Consider using numpy percentile for VaR - Remember to annualize metrics where appropriate

Risk Metrics for Equal-Weight Sector Portfolio (Training Period):

Maximum Drawdown: -0.1618

Sortino Ratio: 1.0901

VaR (95%): -0.0144

CVaR (95%): -0.0216Question 4.2: CAPM Analysis

Calculate CAPM metrics (alpha and beta) for sector portfolios. Compare the risk-adjusted performance across different portfolio strategies.

Hint: - Download market data (S&P 500) for the same period - Use linear regression to calculate beta - Remember to annualize alpha

[*********************100%***********************] 1 of 1 completed

/var/folders/dr/3gd86y8j4w19p8jdnqy5s65m0000gp/T/ipykernel_70455/2328182781.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

alpha = model.params[0] * 252

/var/folders/dr/3gd86y8j4w19p8jdnqy5s65m0000gp/T/ipykernel_70455/2328182781.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

beta = model.params[1]

/var/folders/dr/3gd86y8j4w19p8jdnqy5s65m0000gp/T/ipykernel_70455/2328182781.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

alpha = model.params[0] * 252

/var/folders/dr/3gd86y8j4w19p8jdnqy5s65m0000gp/T/ipykernel_70455/2328182781.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

beta = model.params[1]

/var/folders/dr/3gd86y8j4w19p8jdnqy5s65m0000gp/T/ipykernel_70455/2328182781.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

alpha = model.params[0] * 252

/var/folders/dr/3gd86y8j4w19p8jdnqy5s65m0000gp/T/ipykernel_70455/2328182781.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

beta = model.params[1]

/var/folders/dr/3gd86y8j4w19p8jdnqy5s65m0000gp/T/ipykernel_70455/2328182781.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

alpha = model.params[0] * 252

/var/folders/dr/3gd86y8j4w19p8jdnqy5s65m0000gp/T/ipykernel_70455/2328182781.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

beta = model.params[1]

/var/folders/dr/3gd86y8j4w19p8jdnqy5s65m0000gp/T/ipykernel_70455/2328182781.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

alpha = model.params[0] * 252

/var/folders/dr/3gd86y8j4w19p8jdnqy5s65m0000gp/T/ipykernel_70455/2328182781.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

beta = model.params[1]

/var/folders/dr/3gd86y8j4w19p8jdnqy5s65m0000gp/T/ipykernel_70455/2328182781.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

alpha = model.params[0] * 252

/var/folders/dr/3gd86y8j4w19p8jdnqy5s65m0000gp/T/ipykernel_70455/2328182781.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

beta = model.params[1]

Equal-Weight Portfolio CAPM Metrics:

Training Period - Alpha: 2.8582%, Beta: 0.9390

Testing Period - Alpha: 0.6888%, Beta: 0.9013

Min Variance Portfolio CAPM Metrics:

Training Period - Alpha: 5.2233%, Beta: 0.6415

Testing Period - Alpha: -1.0409%, Beta: 0.5726

Max Sharpe Portfolio CAPM Metrics:

Training Period - Alpha: 9.7843%, Beta: 0.8203

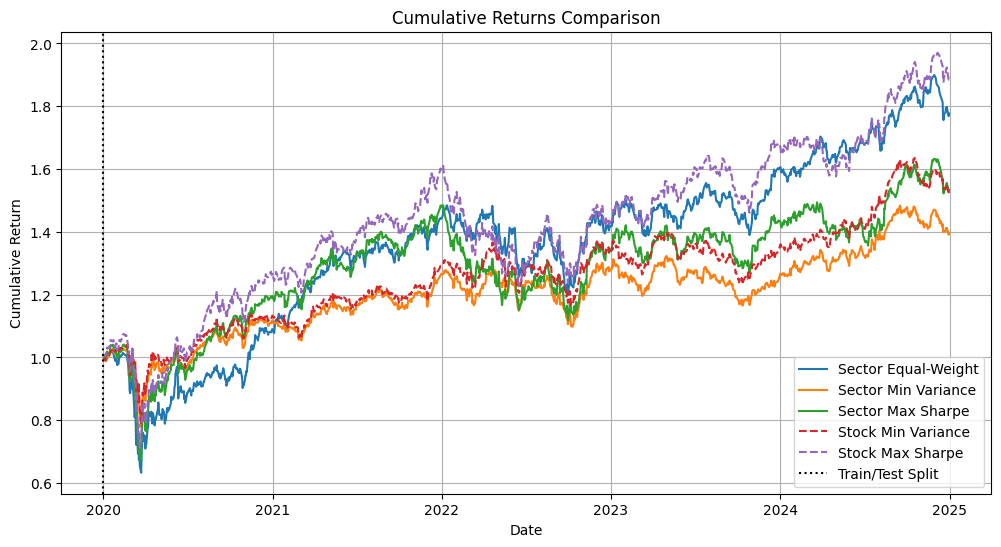

Testing Period - Alpha: -1.7344%, Beta: 0.8535Question 4.3: Performance Comparison

Compare the performance of sector-based portfolios with the individual stock portfolios from Part 2. Create visualizations showing the cumulative returns and risk metrics for both approaches.

Hint: - Use the optimal portfolios from both Parts 2 and 3 - Plot cumulative returns on the same graph - Create a summary table of risk metrics

Risk Metrics Comparison (Testing Period):

Sector Equal-Weight:

Maximum Drawdown: -0.3801

Sortino Ratio: 0.6716

VaR (95%): -0.0170

CVaR (95%): -0.0311

Sector Min Variance:

Maximum Drawdown: -0.2407

Sortino Ratio: 0.4855

VaR (95%): -0.0136

CVaR (95%): -0.0229

Sector Max Sharpe:

Maximum Drawdown: -0.3563

Sortino Ratio: 0.5206

VaR (95%): -0.0174

CVaR (95%): -0.0301

Stock Min Variance:

Maximum Drawdown: -0.2395

Sortino Ratio: 0.6236

VaR (95%): -0.0134

CVaR (95%): -0.0226

Stock Max Sharpe:

Maximum Drawdown: -0.3405

Sortino Ratio: 0.7347

VaR (95%): -0.0177

CVaR (95%): -0.0309

Risk Metrics Comparison (Testing Period):

Sector Equal-Weight:

Maximum Drawdown: -0.3801

Sortino Ratio: 0.6716

VaR (95%): -0.0170

CVaR (95%): -0.0311

Sector Min Variance:

Maximum Drawdown: -0.2407

Sortino Ratio: 0.4855

VaR (95%): -0.0136

CVaR (95%): -0.0229

Sector Max Sharpe:

Maximum Drawdown: -0.3563

Sortino Ratio: 0.5206

VaR (95%): -0.0174

CVaR (95%): -0.0301

Stock Min Variance:

Maximum Drawdown: -0.2395

Sortino Ratio: 0.6236

VaR (95%): -0.0134

CVaR (95%): -0.0226

Stock Max Sharpe:

Maximum Drawdown: -0.3405

Sortino Ratio: 0.7347

VaR (95%): -0.0177

CVaR (95%): -0.0309