The Multi-Layer Perceptron (MLP)

The Building Block: MLP Architecture

Section 1.6 - From Biological Neurons to Artificial Networks

Inspiration

MLPs are loosely inspired by how biological neurons process information:

- Dendrites: Receive inputs like the feature vector \[ \mathbf{x} \]

- Cell body: Aggregates signals by computing the weighted sum \[ \mathbf{w}^\top \mathbf{x} + b \]

- Axon: Transmits the output through synapses via the activation function \[ \varphi \]

Section 1.7 - Mathematical Formulation

Single Neuron (Perceptron)

For an input vector \[ \mathbf{x} \in \mathbb{R}^d, \] the computation is as follows:

Computation:

\[

z = \mathbf{w}^\top \mathbf{x} + b,

\] \[

a = \varphi(z).

\]

Where: - \[\mathbf{w} \in \mathbb{R}^d\] is the weight vector (learnable) - \[b \in \mathbb{R}\] is the bias term (learnable) - \[\varphi\] is the non-linear activation function

Full MLP Layer

A layer with ( n ) neurons produces an output vector \[ \mathbf{a} \in \mathbb{R}^n: \]

Matrix Form:

\[

\mathbf{a} = \varphi(\mathbf{W}\mathbf{x} + \mathbf{b}),

\]

Where: - \[\mathbf{W} \in \mathbb{R}^{n \times d}\] is the weight matrix - \[\mathbf{b} \in \mathbb{R}^n\] is the bias vector

Section 1.8 - Layered Composition

Key Components

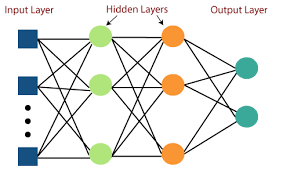

- Input Layer: Raw features (e.g., financial ratios, price returns)

- Hidden Layers: Successive transformations

\[ \mathbf{h}^{(l)} = \varphi\left(\mathbf{W}^{(l)}\mathbf{h}^{(l-1)} + \mathbf{b}^{(l)}\right) \] - Output Layer: Task-specific format

- Regression: Uses a linear activation (e.g., to predict stock price)

- Classification: Uses softmax (e.g., to generate buy/hold/sell signals)

Section 1.9 - Activation Functions

| Function | Formula | Financial Use Case |

|---|---|---|

| ReLU | \[\max(0, z)\] | Default for hidden layers |

| Sigmoid | \[\frac{1}{1+e^{-z}}\] | Probability outputs (0-1) |

| Tanh | \[\frac{e^z - e^{-z}}{e^z + e^{-z}}\] | Normalized outputs (-1 to 1) |

| Linear | \[z\] | Final layer for regression |

Section 1.10 - Why Hierarchical Layers Matter

Financial Feature Learning

- Layer 1: Extracts simple patterns

(e.g., momentum, mean reversion) - Layer 2: Combines patterns

(e.g., momentum + volatility regime) - Layer 3: Leads to a strategic decision

(e.g., optimal portfolio weight)

Example:

Raw Input → Volatility Estimates → Regime Detection → Trade Signal

Section 1.11 - Code Sketch (Keras)

from keras import layers, models

# Simple MLP for return prediction

model = models.Sequential([

layers.Dense(32, activation='relu', input_shape=(num_features,)),

layers.Dense(16, activation='tanh'),

layers.Dense(1) # Linear activation for regression

])Historical Note

MLPs gained prominence in the 1980s-90s for: - Stock price prediction (White, 1988) - Credit scoring (Altman et al., 1994)

However, they were limited by computational power until the resurgence of deep learning in the 2010s.